What are Factors?

Factors are systematic risk exposures explaining a stock return. Investors are using factors to improve their portfolios in many ways. Factors can enhance risk-adjusted returns, limit portfolio turnover, lower volatility, improve diversification and increase transparency.

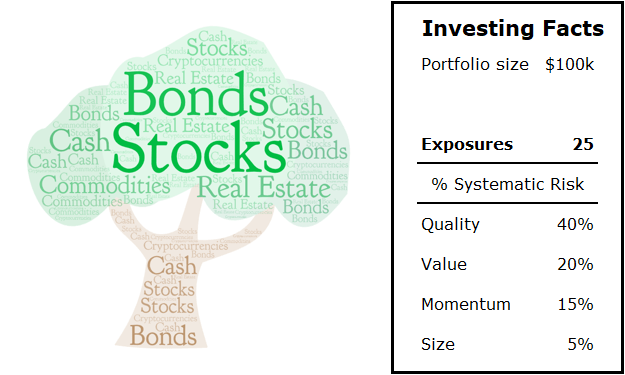

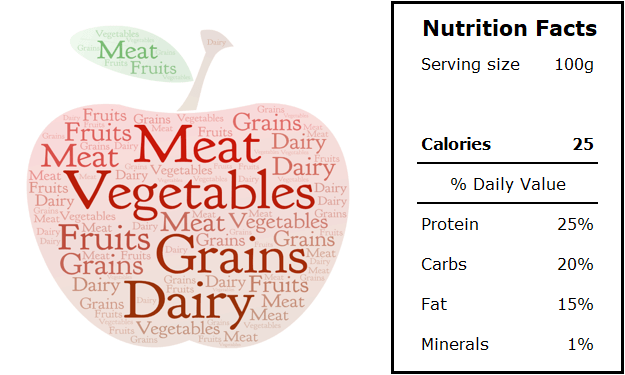

Factors are to investing the same way that nutrients are to nutrition. There are six different nutrients: fats, carbs, vitamins, proteins, minerals and water. Any food provides your body energy and any stock gives your portfolio return. Use the slider to the right for the comparison.

Financial Factors

Why Invest With Us

Factor investing is our specialty. We are on the edge of innovation and develop new strategies to help meet client’s needs. Most of our competitors are providing investable products with exposure to single factors or plain vanilla multi-factor strategies. We instead build robust multi-factor strategies with less conventional metrics that we have researched and time-tested over the last three business cycles. We believe that to be successful, we have to be different.